Business

What is the difference between revenue and profit?

Understand the difference between revenue and profit. Revenue represents the total income generated by a business, while profit denotes the remaining earnings after subtracting all expenses.

Still many people are confused between revenue and profit, so let’s delve into it in detail in the article below to provide answers to all your questions.

What is revenue?

Revenue is also known as income, which is all money collected in the process of buying and selling goods, providing services, and other activities of individuals and organizations. This is also the basis for businesses to make revenue reports.

What is the revenue implication?

In terms of meaning, revenue is known as income – an important revenue so that every business can pay costs and related expenses during business operations and service provision. For example, office and store rental costs, fees and charges, taxes for state agencies, etc.

This is also an essential amount to help maintain and develop the business in the long term, also known as revolving capital to help promote the process of re-operation or to develop business activities on a larger scale.

What is profit?

Profit is the reward for the risk taken by a businessman to run his business, i.e. it is the return on the investments he makes. It is essential for the growth and long-term survival of every business, in fact, the success of a business depends solely on its ability to make a profit.

Profit can be obtained after deducting some costs such as: Transaction costs, Office and management costs, Sales and distribution costs, Taxes, Interest, Dividends, etc. Below are types of profits:

Gross Profit: The profit achieved after deducting transaction costs from Sales is called Gross Profit.

Net profit: The profit earned after deducting office and management expenses, selling expenses and other expenses from revenue is net profit.

Main difference between revenue and profit

- Revenue is the amount of money a business receives through various trading activities while Profit is the surplus remaining after reducing all types of costs and expenses.

- Revenue is necessary to run a business efficiently and effectively. On the other hand, Profit is necessary for the survival and development of a business in the long term.

- Revenue does not depend on profit in any way, but profit depends on revenue. In other words, the more revenue, the more profit.

An example in the following story so you can understand better:

The following story will help differentiate revenue and profit types:

We are a TV store. We import 10 TVs at a price of 7 million/unit. Then we sell 10 million/unit. At this time:

- Revenue = 10 TVs x selling price of 10 million = 100 (million)

- Gross profit = Revenue – cost of imported products = 100 – 10×7 = 30 (million)

To sell a TV, we also have to spend money to open a store, pay sales staff salaries, and taxes. This total cost is 1 million.

Net profit = gross profit – costs (sales, business management costs, taxes) = 30 – 1 million x 10 units = 20 (million)

Is revenue or profit more important?

When people refer to a company’s profits, they are often not referring to the company’s profits or operations, but to its net income. This is the amount a business earns after deducting costs or profits, and a company may generate revenue but may suffer a net loss.

Profits and revenue are both important, profits tell us exactly about the financial situation of a company or business. Because the business’s debts and some expenses have been accounted for by the business when calculating profits.

Revenue and profit are two extremely important numbers, shown on the operating process and business reports of a company or enterprise. Wall revenue is located on the top line of the statement and profit is usually located on the bottom line.

Although these two metrics are both very important when considering investment decisions, revenue is the income a company generates without taking into account other expenses. However, when determining profit, you need to pay attention to the costs that the business makes such as wages, debts, taxes and other expenses.

Thus, although revenue and profit both have big differences, they are closely related to each other. So when you understand the business’s financial statements and the difference between revenue and profits, you can already practice accounting tasks and establish effective budgets.

Conclusion:

- Revenue is the total revenue earned from sales.

- Gross profit = Revenue – cost of imported products

- Net profit = Gross profit – costs related to business management, sales, taxes.

I hope this simple article of mine will help people read and understand the business at a glance, take the first steps to better understand the business and feel more secure in their assets. Wishing everyone to maintain discipline and perseverance.

Read Also:

Business

What is an invoice? The complete guide

What is an invoice? An invoice is a request for payment issued by a seller to the buyer of goods or services after the sale, detailing the goods supplied or work performed, and the amount to be paid in return.

Definition of an invoice

The invoice is an accounting document that proves a purchase or sale. It lists the goods and services provided by your company, and at the same time indicates their price, as well as the total amount to be paid by the buyer.

The invoice is therefore essential since it is the document which identifies the creditor (you) and the debtor (your customer) and serves as a request for payment. But to be valid, it must meet certain conditions.

According to current legislation, the invoice is obligatory. Please note that the buyer has the right to claim one if it has not been sent to him.

Brief history of invoices

Before contemporary bills, counting sticks were used, followed by inscriptions on bones, such as the Ishango stick dating back approximately 20,000 to 25,000 years in the Congo.

The first invoice-like documents come from the Middle East: the Sumerians developed cuneiform around 3200 BC. recording on clay tablets various transactions, including the receipt of livestock.

The Industrial Revolution in the 18th century brought notable improvements in invoicing, and then accounting machines in the 19th century revolutionized this area.

In the 20th century, the appearance of logos on invoices marked a further step, before EDI in the 1960s facilitated the exchange of financial documents. Since the 1990s, invoices have migrated to web platforms.

Invoice functions

Everything has its reason for being and the invoice is no exception: you will be surprised to learn the importance of this document. Among the most significant functions of a typical invoice are that it allows you to:

Maintain transaction history: Probably the most important function of all, the invoice leaves a distinct written record of business activity. It indicates who is responsible for the provision of services or delivery of goods, payment details and the conditions of execution of the contract.

Helping accountants: What is an invoice in accounting? Following the previous point, invoices are essential for the proper maintenance of general accounting. These documents are used to determine the total amount of accounts payable and creditors. In addition, invoices are used to record taxable revenue, which helps a business or self-employed person declare their income. Good invoicing can be an additional asset in the event of an audit.

Legal representation function: Invoices can serve as a reliable mediation for possible disputes between a buyer and a seller. In this way, the risks of fraudulent activities on either side are significantly reduced.

A powerful tool for analysis: Invoices help collect information about customer purchasing habits, the most commonly ordered types of goods or services, peak periods, and more. This data will be very useful in planning the future development of the company.

An invoice can fulfill a wide range of business tasks. It provides clear order information to both parties and leaves virtually no room for fraud.

What is the role of invoice?

The invoice is an essential document which will allow:

- monitoring the various commercial transactions, essential for your accounting, your tax return, but also to know your financial situation precisely;

- to prove what you actually earned;

- to justify the agreement concluded with the client. To do this, you will need to present it clearly to avoid misunderstandings;

- to request payment from your buyer. You will thus receive the money due for your work;

- to take action in the event of unpaid debts ;

- to promote your activity and develop the image of your company through a logo or links to social media.

What are the different types of invoices?

There are several types of invoices :

- The standard invoice: this is the most common document. It can be used for several sectors of activity and consists of a very basic format containing all the necessary information.

- Commercial invoice: it is used in international trade for shipping goods from one country to another.

- The proforma invoice: it gives the buyer an estimate of the price of the products or services.

- The closing invoice: which closes a contract between a service provider and a client.

- The credit note: it allows you to cancel or modify an invoice already established.

- The deposit invoice: it allows you to justify the amount paid upstream of the delivery or production of a good or service.

What items should be included on the invoice?

For the invoice to be valid, it must include a certain number of mandatory information :

- The mention “ invoice ”,

- Invoice number,

- Date of issue of the invoice,

- The name or company name of your establishment,

- The head office address, as well as the billing address (if different),

- The VAT number, the SIREN number and the legal form of your company,

- Customer’s name and contact details (if the billing address and delivery address are different, you must enter both),

- Customer’s VAT identification number if it is a professional,

- The detailed account of each service and/or product, in quantity and unit price excluding tax,

- The price of labor,

- Total amount to be paid excluding tax,

- The applicable VAT rates and amounts, as well as the total amount all taxes included,

- Payment conditions (payment deadlines, amount of any deposit),

- Penalties for late payment may apply.

How to create an invoice online?

Save time and make it easier to create your invoices with online invoicing software.

Simply let the software guide you when creating your first invoice.

If you use software that complies with the anti-fraud law, you have the assurance of creating a clear invoice that complies with the requirements of regulations.

Invoice with or without VAT and choose the legal notice that corresponds to your status (self-liquidation, self-employed, exemption, reduced VAT, etc.).

When you provide your legal, product and customer information, it is recorded in your database.

Thus, all subsequent invoices will automatically include your contact details and legal notices and you will be able to import your products and customers in just a few clicks.

Tips for writing an invoice

First of all, be as clear and complete as possible in the description of your services and/or products. The customer wants to know concretely what they are buying! A beautiful presentation also makes all the difference and directly reflects your professionalism.

On the other hand, know that using invoicing software will allow you to save time and avoid oversights. This very practical tool not only guarantees you compliant invoices, but also considerably facilitates administrative management. In addition, your documents can be viewed from anywhere, and tracking and reminders are greatly simplified.

In summary

The invoice is a commercial, legal and accounting document established by a professional during the sale of goods or the provision of services.

This document, published in two copies, proves that the sale took place.

To be admissible, an invoice must contain a certain number of mandatory information. You can add other information that you deem relevant, as well as your conditions of sale.

To save time editing your invoicing documents and avoid errors, we advise you to use invoicing software.

Read Also:

3 Types of Invoices in Business Transactions, What Are They?

Business

Pros and Cons of BYOD: Opportunities and Risks For Companies

With increased remote work from home offices during the previous pandemic, the use of private devices has also become more and more established. Even if this solution initially seems helpful for companies and employees, the concept poses some risks and dangers for IT security.

We will show you how the use of your own technical devices can be combined with maintaining data security and what companies need to pay attention to. Learn about the pros and cons of BYOD (Bring Your Own Device) policies to make informed decisions for your organization.

What should you consider when it comes to data security

Access to sensitive company data from private devices often poses threats to a company’s IT security situation. In principle, any digital device that has a network connection can pose a risk to IT security – whether it is currently used hardware and software or old devices that are still in the network. Private gadgets used in BYOD only have limited control: after all, they continue to be used in non-company networks and for personal purposes. This raises the risk of malware such as rootkits, and company data stored may be more vulnerable to cybercriminal access. That’s why companies should develop a comprehensive security concept before they allow the use of third-party devices. All security guidelines for handling can be recorded in this so that the “Bring your own device” concept can be successfully introduced and all risks can be minimized as early as possible.

Explore The Pros and Cons of BYOD

Pros of BYOD

Working according to the bring your own device principle has numerous advantages for users and institutions. Employees who can bring their personal mobile device into the company do not need to get used to a different operating system. You put together the features of your laptop according to your personal wishes. This increases employee satisfaction.

Using your own mobile device for work allows for greater flexibility. When smartphones or tablets are used, employees gain greater mobility .

Bring Your Own Device means cost savings for companies. There is no need to purchase new computers if employees use their own.

Working with your own, familiar device in schools, universities or libraries means greater user-friendliness . With good WiFi coverage, smartphones, tablets or laptops can be used flexibly and mobilely in different locations, unlike stand-alone PCs. Likewise, there is no need to invest in a large part of the IT equipment for educational institutions because they do not have to provide computers.

Cons of BYOD

The bring your own device principle also has disadvantages for companies and institutions. A serious factor is the lack of data security when accessing an internal network or sensitive company data. Using your own devices means a high degree of heterogeneity or diversity in a company’s hardware and software equipment. The different laptops, smartphones or tablets require more effort for IT management, which puts the cost savings when purchasing company-owned devices into perspective.

Data security with the bring your own device principle

Bring Your Own Device complicates administration and control, meaning employees’ private devices represent a security gap for the company’s internal network.

If a private laptop is affected by malware and is connected to the network of a facility, a Trojan can read the entries on the keyboard and thus logins and passwords. This is how hackers gain access to sensitive data. If the network of a company or institution is open to external access – for example via cloud services – then outsiders can gain access. This also applies to password-protected logins.

Bring Your Own Device and the General Data Protection Regulation (GDPR)

There is also a legal aspect. With Bring Your Own Device, personal or company-internal data is accessed and stored on a private device. This does not comply with the guidelines of the General Data Protection Regulation (GDPR). It must be legally clarified how data and business secrets are handled. In addition to reduced data security, the flexible use of private devices also means stress for employees. If you use your laptop in your free time and can be reached at any time, it is difficult to separate your private and work life.

Advantages

- Efficient work on your own device

- High employee satisfaction

- High user-friendliness

- Flexibility & mobility

- Cost savings for companies

Disadvantages

- Lack of data security

- Security gap for the company network

- Legal objection: GDPR

- Heterogeneous hardware and software

- Difficult administration for IT

Guidelines and Safeguards for Bring Your Own Device

When applying the bring your own device approach, it is important to weigh up the advantages and disadvantages as well as the costs and benefits. In addition to small hurdles such as the fact that software such as Microsoft Office on private laptops is not licensed for commercial use in companies, ensuring data security requires a certain amount of effort. It is worth setting up internal company guidelines for these purposes. The basic procedures include regularly updating the operating system, using a virus scanner and uniform software to protect against malware.

What are the future trends and directions of BYOD?

Future trends and trends in BYOD (Bring Your Own Device) are constantly evolving depending on technological advances, changes in ways of doing business and the needs of employees. Here are the possible future trends and directions of BYOD:

1. Greater Mobility and Flexibility:

With mobile device technology constantly evolving, BYOD policies can become even more mobile and flexible. The spread of 5G and next generation connection technologies will provide employees with access to higher speed data transmission and stronger connections. This can enable the workforce to work more efficiently without being tied to the local office.

2. Increasing Security Measures:

With the increasing use of BYOD, security concerns are also increasing. In the future, businesses will adopt stronger security measures and data protection strategies for BYOD policies. By using security technologies such as biometric authentication, multi-factor authentication and remote data encryption, business data will be protected more securely.

3. Compliance and Regulations:

BYOD use triggers various compliance requirements such as data protection regulations and personal data privacy laws. In the future, businesses may have to update BYOD policies and improve data protection processes to ensure such compliance.

4. More BYOD Support and Consultancy:

As BYOD becomes more complex, companies will need more consultancy and expertise to develop, manage and support BYOD policies. Cybersecurity consultants and technology providers will become more important to offer appropriate BYOD solutions to organizations.

5. BYOD and IoT (Internet of Things) Integration:

With the increasing use of Internet of Things (IoT) devices, BYOD policies can expand to cover more device types. Employees can also be integrated to manage IoT devices and monitor their data through BYOD devices.

6. Virtualization and Cloud-Based Solutions:

Virtualization technology and cloud-based applications can help in the successful implementation of BYOD policies. It can improve security and data protection measures by providing access to business clients through employees’ personal devices. Likewise, cloud-based applications can offer a more secure environment for accessing data and collaborating.

Conclusion:

There are many pros and cons that should be analyzed before adopting a BYOD strategy. A BYOD strategy can save money and increase productivity by promoting familiarity with a work device. However, such a strategy may also entail certain risks for the company. Before implementing a BYOD strategy, both employees and employers should thoroughly research the policies and risks to familiarize themselves with the key advantages and disadvantages.

FAQs

What should be contained in a BYOD policy?

BYOD policies must take into account general or industry-specific compliance regulations . Even if employees use personal devices, the company must still ensure that data is protected. They must also understand the liability linked to compromised data.

What security challenge does BYOD pose for networks?

The biggest challenge to widespread BYOD adoption is security, closely followed by compliance issues . Security is not an aspect that can be ignored; Using corporate apps on employee-owned mobile devices can lead to data leakage and connectivity issues.

Read Also:

Business

3 Types of Invoices in Business Transactions, What Are They?

Invoices are one of the documents or files that are quite important in the company. Generally, these documents relate to payment of bills for goods or service transactions. In this article, you will be invited to understand more about what an invoice is, its types, components, purpose, and also its benefits for companies.

What is an Invoice?

The term invoice may sound less familiar to the ear than invoice. However, this term has usually become everyday food for an accountant or finance department in a company.

An invoice is a file of payment bills for transactions for certain goods or services. It contains all billing details written as proof of billing/payment to customers.

In another sense, an invoice is a written document containing a debt collection letter. The party who makes the document is the seller, who then gives it to the buyer as the party who has the debt. In more detail, the invoice contains the name of the product, price and date of purchase of goods/services.

Generally, this billing file is created in triplicate, to be given to the buyer, as a financial file, and a letter of proof for the seller himself. Apart from being a billing document for certain transactions, invoices also function to collect transactions in the form of credit.

Types of Invoices

You need to understand that the billing file has several types, namely regular, consular and proforma invoices. You can see the explanation in the review below.

1. Regular Invoices

Invoices that are commonly used in buying and selling goods/services transactions are regular invoices. Usually, regular invoices are used for simple transactions and contain details of the goods, quantity of goods and the total amount to be paid.

2. Consular Invoice

In particular, consular invoices are created for billing for various transactions on an international scale, such as export-import activities. This document must also be legalized and obtain permission from the country concerned.

3. Proforma Invoice

The last type of invoice is a proforma which is issued for billing for sale and purchase transactions carried out periodically. This invoice is only temporary and will later be replaced with a general type of invoice when the transaction is completed.

Components in Invoice

As previously discussed, the invoice contains a record of the sale and purchase transaction of goods or services consisting of the title, customer identity and details of the goods or services. The following is the explanation.

1. Invoice Title

The invoice title is the main component that must be included in the billing invoice. Even though it seems trivial, the title of the invoice will make it easier for both sellers and buyers to find proof of transactions when they are needed at any time. It is best if the title is written at the top center in capital letters.

2. Customer Identity

The next component that must be included in the invoice is the customer’s identity, such as the name and mailing address when creating the invoice. Information on the customer’s identity will make it easier for both parties to understand the document further, as well as assist the customer in sending a check to the seller.

3. Details of goods/services

To make it clearer, the invoice should also specify the names of goods/services in detail by paying attention to the following things.

- A list of goods or services that includes the name of the product, price per unit, and the amount to be paid.

- The date the invoice was created includes the purchase date, issue date and payment due date.

- Invoice number which will later be useful in archiving invoices. Generally, invoice numbers are generated with a special code.

Purpose of Invoicing

Making invoices is not without purpose. Even though it only contains details of bills for certain goods or services, this document is very important for a company. The question is, what is the main purpose of creating the invoice?

As previously mentioned, an invoice is a document that is proof of payment for the sale and purchase of goods or services made by the seller for his customers. The existence of written evidence is very important to avoid violations of the sale and purchase transaction agreement between the seller and the buyer.

Apart from that, the invoice is a quite crucial document for the company because it contains transactions related to the incoming and outgoing company money, so that at any time it will definitely be needed as a company archive.

Benefits of Invoices for Companies

Considering how important an invoice is for a company, below we will explain in more detail the benefits of this invoice.

1. More Systemized Business Document Management

Document management within the company is very important, especially for reports or internal audits that may occur at any time. Therefore, the existence of this invoice will later help relevant departments within the company in managing internal documents.

2. Contains precise and accurate information

Even though it seems trivial, information written completely, precisely and accurately in an invoice will be very useful for the continuity of a company’s business in the future.

3. Make it easier for related departments to access invoices

Invoices will help the company’s business and make it easier for business people who want to access them from the storage room. This will be very useful for knowing all the details of important information that supports the achievement of long-term business goals.

Apart from invoices, there are many other important documents that are very useful for both companies and employees, such as pay slips. Pay slip recording generally contains details of the components of the work wage itself such as basic salary, allowances, bonuses, overtime pay, and various deductions such as taxes, etc.

Each employee in each position will of course receive a different number of salary components and this requires an accurate and thorough recapitulation and calculation process.

Read Also:

-

Top2 years ago

Top2 years ago2022 US House committee releases Trump’s tax returns, capping a years-long battle

-

Top2 years ago

Top2 years agoInterview With Niantic CEO John Niantsullivan

-

News1 year ago

News1 year agoUSPS EMPLOYEE ASSISTANCE PROGRAM SERVICES AND BENEFITS

-

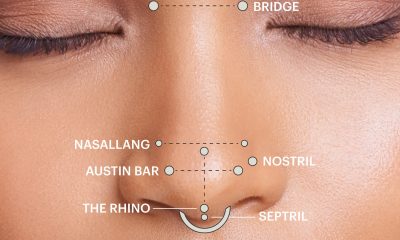

Top1 year ago

Top1 year agoUnderstanding the Healing Process of Nose Piercings – A Comprehensive Guide

-

Auto1 year ago

Auto1 year agoTop Porsche Taycan Incentives: Save Big

-

Business12 months ago

Business12 months agoDoes 7-Eleven Take Apple Pay

-

Business11 months ago

Business11 months agoBeware Of Fake Emails And Fake Apple Pay Images

-

Tech1 year ago

Tech1 year agoUSPS LiteBlue ePayroll: A Comprehensive Guide