Cryptocurrency

Bridging the Gap: Binbex Futures

Binbex Futures, a cutting-edge futures exchange platform, aims to revolutionize the crypto trading landscape by combining the speed and convenience of centralized exchanges (CEX) with the security advantages of decentralized exchanges (DEX).In the dynamic world of cryptocurrency trading, innovation and evolution are essential for platforms to stay relevant and provide traders with the best possible experience. This article will explore how Binbex works, its safety measures for traders, the pros and cons of trading on the platform, and its potential impact on the cryptocurrency industry.

How Binbex Works?

Binbex Futures stands out by offering real-time trading with instant, on-chain settlement. Using BSV Blockchain technology, Binbex eliminates the long delays and costs associated with traditional futures trading. This innovative approach ensures traders execute transactions quickly and securely, resulting in a smoother and more efficient trading experience.

Binbex combines the advantages of a centralized and decentralized exchange at its core. It provides a user-friendly interface, enabling traders to navigate the platform and execute trades quickly and conveniently. Simultaneously, it leverages the inherent security features of blockchain technology, such as transparent and immutable transaction records, to enhance the safety of user funds and information.

Is Binbex Safe for Traders?

Security is a paramount concern for any cryptocurrency exchange, and Binbex recognizes the importance of safeguarding user assets. The platform employs robust security measures, including two-factor authentication (2FA), encryption protocols, and cold storage for storing most user funds offline. These measures help mitigate the risk of unauthorized access and potential security breaches.

Additionally, Binbex prioritizes compliance with regulatory standards to establish a trustworthy trading environment. By adhering to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, the platform ensures the legitimacy of user accounts and transactions, reducing the likelihood of fraudulent activities.

Benefits and Drawbacks of Trading on Binbex

Like any trading platform, Binbex Futures has its advantages and disadvantages.

Pros:

Speed and Convenience:

Binbex’s centralized features enable fast order execution, real-time trading, and a user-friendly interface catering to beginners and experienced traders.

Enhanced Security:

By leveraging the security benefits of blockchain technology, Binbex minimizes the risk of hacks and ensures the safety of user funds.

On-Chain Settlement:

The instant on-chain settlement provided by Binbex eliminates the need for intermediaries, reducing transaction costs and increasing efficiency.

Regulatory Compliance: Binbex’s adherence to regulatory standards enhances trust and legitimacy on the platform.

Cons:

Limited Cryptocurrency Availability:

As a relatively new platform, Binbex may have a more limited selection of tradable cryptocurrencies than established exchanges.

Market Liquidity:

The liquidity of specific trading pairs on Binbex may vary, which could result in slippage during high-volume trading.

Learning Curve:

While Binbex strives for user-friendliness, newcomers to cryptocurrency trading may still need to familiarize themselves with the platform’s features and functionalities.

How to start trading on BimBex?

Sign Up:

To create a new account, visit the Binbex Futures website and click either the “Sign Up” or “Register” button.

Enter the necessary information, including a valid email address and a robust and secure password.

Ensure that you agree to the platform’s terms and conditions.

Verify Your Account:

You may need to complete the verification process after registering. This typically involves providing identification documents, such as a government-issued ID, passport, and proof of address. Follow the instructions provided by Binbex to complete the verification process successfully.

Secure Your Account:

Once verified, take additional steps to secure it. Enhance your account security by enabling two-factor authentication (2FA), providing an extra layer of protection. You may link your account to a mobile authenticator app such as Google Authenticator or receive SMS codes to enhance security.

Deposit Funds:

To start trading, you must deposit funds into your Binbex account. Log in to your account and navigate to the “Wallet” or “Funds” section. Choose the cryptocurrency you want to deposit and generate a deposit address. Transfer the desired amount of cryptocurrency from your wallet or another exchange to the provided deposit address.

Familiarize Yourself with the Trading Interface:

Explore the Binbex trading interface to understand its features and functionalities. The platform typically provides a user-friendly interface with various trading tools, charts, and order types. Take a moment to acquaint yourself with the layout and navigation of the platform.

Choose a Trading Pair:

Choose the trading pair you wish to trade. Binbex provides a variety of trading pairs, including BTC/USDT or ETH/BTC, allowing you to exchange one cryptocurrency for another or a stablecoin like USDT (Tether).

Placing an Order:

Once you have selected a trading pair, you can choose from different order types on Binbex. On this platform, you can place market orders to buy or sell at the current market price. Alternatively, you can use limit orders to set a specific price for buying or selling your preferred cryptocurrency.

Monitor and Manage Your Trades:

After placing an order, monitor the market and manage your trades accordingly. The trading interface lets you view your open orders, trade history, and account balance. Set stop-loss and take-profit levels if necessary to manage your risk effectively.

Withdraw Funds:

If you wish to withdraw your funds from Binbex, navigate to the “Wallet” or “Funds” section and select the cryptocurrency you want to remove.

Enter your external wallet address and specify the amount you wish to withdraw.

Follow the necessary security steps, such as confirming the withdrawal via email or 2FA.

Stay Informed and Updated:

Keep yourself informed about the latest market trends, news, and developments in the cryptocurrency industry. You can utilize this information to make well-informed trading decisions and adjust to the ever-changing market conditions.

Conclusion:

Binbex Futures presents a promising solution to the challenges faced by traders in the cryptocurrency market. By combining the best aspects of centralized and decentralized exchanges, the platform offers traders a unique blend of speed, convenience, and security. With its real-time trading and on-chain settlement, Binbex aims to streamline futures trading, reducing delays, costs, and other potential obstacles.

As with any trading platform, users must research and exercise caution when engaging in trading activities. While Binbex provides enhanced security measures and regulatory compliance, staying vigilant and following best practices to protect personal information and funds are essential.

Binbex’s innovative approach demonstrates the potential for further advancements in the cryptocurrency industry, paving the way for developing platforms prioritizing user experience and security. As the crypto market continues to evolve, Binbex Futures aims to be at the forefront, offering traders a reliable and efficient trading environment.

Related Article:

Cryptocurrency

Bitcoin For beginners: The Ultimate Guide

Welcome to “Bitcoin for Beginners: The Ultimate Guide.” If you’ve ever been curious about cryptocurrencies and want to understand Bitcoin, you’ve come to the right place. Recently, Bitcoin has gained significant attention as a revolutionary digital currency operating independently of traditional financial institutions. This guide provides a comprehensive and user-friendly introduction to Bitcoin, perfect for those new to cryptocurrencies.

What is Bitcoin?

Bitcoin is a revolutionary digital currency created in 2009 by an anonymous figure or group known as Satoshi Nakamoto. It operates on a decentralized network, using advanced cryptographic techniques to prevent fraudulent duplication and counterfeiting. Bitcoin’s scarcity and growing acceptance make it a game-changer in finance.

How Does Bitcoin Work?

Imagine Bitcoin as a digital treasure chest filled with coins. Each coin is like a piece of gold, but it’s virtual, stored in special digital wallets or exchanges. These coins represent the current value of Bitcoin, but interestingly, you don’t need to own a whole coin. Just like you can have coins and notes of various denominations in your regular wallet, with Bitcoin, you can own fractions of a coin, down to its tiniest unit called a Satoshi – named after the brilliant creator of Bitcoin.

Now, clever blockchain technology makes this digital treasure chest secure and trustworthy. Think of blockchain as a magical book that everyone in the Bitcoin world reads and agrees upon. This book records every transaction, from the first to the most recent. But instead of just being a regular book, it’s made up of “blocks” of information that are “chained” together. This unique structure makes tampering with or altering past transactions incredibly difficult, ensuring an honest and transparent history of who owns what.

You need a pair of magical keys to unlock and move those digital coins from one person to another. One is a public key, like your username, which others use to send you coins. The other is a private key, like your secret password, used to digitally sign transactions and prove you’re the rightful owner of those coins. With these keys, you can confidently send and receive Bitcoin to and from others, knowing that only you control access to your treasure.

Now, here’s the exciting part: Bitcoin mining! Picture a group of treasure hunters competing to find shiny gems deep underground. In the world of Bitcoin, miners are like treasure hunters, but instead of gems, they search for new transactions waiting to be confirmed. They gather these transactions into blocks and, using powerful computers, compete to solve a complex puzzle. The miner who solves the puzzle first is allowed to include their transactions in the blockchain and receive a reward of newly generated Bitcoin for their hard work.

This mining process creates new coins and serves as the treasure chest’s security guard. Miners play a key role in the blockchain system by verifying and adding transactions. This ensures that no one spends more coins than they have, effectively preventing fraudulent activity. It’s like having honest treasure guards working around the clock to maintain the integrity of the treasure chest.

And that’s how Bitcoin works! It’s a fascinating digital currency with a secure and transparent system powered by blockchain, secured by private and public keys, and maintained by dedicated miners. So next time you think about Bitcoin, remember it’s like a treasure hunt in the digital realm, where fractions of coins are kept safe in a magical treasure chest for everyone to enjoy!

What is Bitcoin Used For?

Cryptocurrency, commonly known as Bitcoin, is a widely used digital currency. Bitcoin, created by an anonymous individual or group using the name “Satoshi Nakamoto,” has recently garnered much attention. Its uses extend beyond being a mere investment and have expanded into various areas of commerce and financial transactions. Here are some of the primary purposes for which Bitcoin is used.

Digital Currency:

Bitcoin is a decentralized digital currency, meaning it operates without the control of any central authority or government. It exists solely in electronic form and can be used for online transactions.

Online Purchases:

One of the key uses of Bitcoin is for online purchases. Many businesses and retailers now accept Bitcoin as a legitimate payment method, offering consumers a fast and secure way to get products and services online.

International Transactions:

Bitcoin’s global nature allows for seamless cross-border transactions. It eliminates the need for currency conversions and traditional banking intermediaries, making international payments more efficient and cost-effective.

Investment and Speculation:

Investing in Bitcoin has gained popularity as an asset choice. Investors purchase and hold Bitcoin, hoping its value will appreciate over time, leading to potential profits when they decide to sell.

Remittances:

Bitcoin is increasingly used for remittances, where people living and working abroad send money back to their home countries. This remittance method can be faster and more cost-effective than traditional services.

Financial Inclusion:

Bitcoin has the potential to offer financial services to individuals who are underserved or excluded from the conventional banking system. Individuals in developing countries can access financial resources through Bitcoin without needing a traditional bank account.

Hedging Against Economic Instability:

Some individuals and institutions view Bitcoin as a hedge against economic instability and inflation. In times of uncertainty, they may allocate funds to Bitcoin to protect their wealth.

Fundraising (ICOs):

In the past, Initial Coin Offerings (ICOs) were a popular way for startups to raise funds. They would issue new cryptocurrencies or tokens, often based on the Ethereum platform, in exchange for Bitcoin or other cryptocurrencies.

Smart Contracts:

Blockchain, Bitcoin’s underlying technology, enables the creation and execution of smart contracts. These self-executing contracts with predefined conditions offer transparency and security in various industries.

Store of Value:

Some people use Bitcoin as a store of value, similar to how gold or other precious metals are used. They believe in its potential as a long-term asset that can preserve purchasing power over time.

Bitcoin serves various purposes beyond its role as a digital currency and investment asset. Its usage spans from facilitating online purchases and international transactions to promoting financial inclusion and helping as a store of value. The versatility and growing acceptance of Bitcoin continues to impact various industries, with its underlying blockchain technology opening up new possibilities for secure and decentralized applications.

What Do You Need to Invest in Bitcoin?

Investing in Bitcoin is relatively straightforward, and you don’t need much to start. Here’s what you need:

Personal Identification Documents:

To comply with regulations and ensure a secure investment process, you’ll typically need to provide some form of identification, such as a government-issued ID or passport.

Bank Account Information:

You’ll need a bank account to fund your Bitcoin investment. Linking your bank account enables you to transfer money to the platform or exchange from which you’ll buy Bitcoin.

Secure Internet Connection:

A fast and secure internet connection is crucial when investing in Bitcoin, as most transactions are conducted online. Use a trusted and encrypted network to protect your personal and financial information.

If you’re using a stockbroker or a cryptocurrency exchange that has already verified your identity, you should not need to submit personal information again. They will likely have your details on record, making the investment process more convenient. Always prioritize security and use reputable platforms when investing in Bitcoin.

How much can I invest in Bitcoin as a beginner?

As a beginner investing in Bitcoin, the amount you can invest depends on your comfort with risk and long-term plans. Some experts suggest keeping your Bitcoin investment below 5% of your net worth. The key is to invest only what you can afford to lose, considering that Bitcoin is a relatively new and highly volatile asset. Be cautious and make sure your investment aligns with your financial goals.

Example: Let’s say you have a total net worth of $10,000. If you follow the advice of keeping your Bitcoin investment below 5% of your net worth, you should invest no more than 5% of $10,000, which is $500.

As a beginner, you could invest up to $500 in Bitcoin. Remember, this is just an example, and the actual amount you choose to invest should depend on your financial situation, risk tolerance, and investment goals. It is important to exercise caution and only invest money that you can afford to lose, given the potential volatility of Bitcoin as a new and developing asset.

How to invest in bitcoin for beginners

Investing in Bitcoin has become easier and more accessible than ever before. If you’re a beginner interested in getting started, here are the essential steps to consider:

Understand the Risks and Rewards:

Bitcoin, like all cryptocurrencies, carries a significant risk of loss due to its extreme volatility. Before investing, evaluate how much risk you can tolerate and how Bitcoin fits into your overall investment strategy.

Choose a Reliable Platform:

- Look for a reputable platform that allows you to buy and sell cryptocurrencies.

- Consider fees, minimum investment requirements, token availability, and security measures.

- Stick to well-established platforms to avoid potential security or liquidity issues.

Select a Secure Wallet:

Since cryptocurrencies are digital assets, you’ll need a secure wallet to store your coins. There are two types: hot wallets (online) and cold wallets (offline). Hot wallets are more convenient but susceptible to hacking, while cold wallets offer better security but can be easier to misplace.

Decide How Much to Invest:

You can buy Bitcoin in fractional shares, so you don’t need to purchase a whole token. Consider your risk tolerance and long-term investment goals when deciding how much to invest. Experts often recommend limiting your investment to under 5% of your net worth.

Manage Your Investments:

You can use Bitcoin used as a currency and an investment. Some investors day-trade Bitcoin for short-term profits, while others take a long-term approach. Choose a strategy that aligns with your financial goals, and be aware of the tax implications of your investment decisions.

Diversify Your Portfolio:

While Bitcoin can be an exciting investment, it’s essential to diversify your portfolio to spread risk. Consider how Bitcoin fits into your broader investment strategy, and don’t rely solely on cryptocurrencies for your financial future.

Always remember that investing in Bitcoin involves risk, and its value can be highly volatile. It’s important to invest only the amount of money you can afford to lose, and to conduct comprehensive research before making any investment decisions. As with any investment, seek advice from a financial advisor to make informed choices.

What are the key advantages and disadvantages of investing in Bitcoin

As a beginner, investing in Bitcoin has its own advantages and disadvantages. Here’s a simple breakdown to help you understand both sides:

Advantages:

- Potential for High Returns: Bitcoin has experienced significant price increases in the past, leading to the possibility of high returns on investment if its value continues to rise.

- Diversification: Adding Bitcoin to your investment portfolio offers diversification as it is not directly tied to traditional assets like stocks and bonds.

- Global Accessibility: Bitcoin operates on a decentralized network, allowing you to invest and transact globally without relying on traditional financial institutions.

- Lower Transaction Fees: Unlike traditional banking and payment systems, Bitcoin transactions often have lower fees, especially for international transfers.

- 24/7 Market: The cryptocurrency market operates 24/7, providing flexibility for trading and monitoring your investments.

Disadvantages:

- Volatility: Bitcoin’s value can fluctuate wildly in short periods, leading to potential losses if the market experiences a downturn.

- Lack of Regulation: As a relatively new and decentralized asset, Bitcoin needs strong regulation, which can increase the risk of scams and fraudulent schemes.

- Security Concerns: Cryptocurrency exchanges and wallets can be vulnerable to hacking and cyberattacks, potentially losing funds.

- Limited Acceptance: While Bitcoin is gaining acceptance, it is only sometimes accepted as a payment method, limiting its use for everyday transactions.

- Complexity: Understanding how Bitcoin works and navigating the cryptocurrency market can be challenging for beginners, requiring research and education.

As a beginner, it’s crucial to consider these factors and conduct thorough research before investing in Bitcoin. While it offers opportunities for potential growth, it also carries risks, and investing only what you can afford to lose is essential. Consulting with a financial advisor and using reputable platforms can help mitigate risks and make informed investment decisions.

Conclusion:

Bitcoin is a revolutionary type of virtual money that functions on a decentralized network, revolutionizing the financial industry. It works through a secure and transparent system powered by blockchain technology, where it stores digital coins in special wallets or exchanges. Bitcoin offers various advantages, including the potential for high returns, global accessibility, and lower transaction fees. However, it also has disadvantages, such as increased volatility, lack of regulation, and security concerns.

As a beginner, it’s essential to understand the risks and rewards associated with Bitcoin investment. Consider your risk tolerance, long-term strategy, and investment amount. Select a reputable platform and a secure wallet to manage your investments effectively. Diversify your portfolio and seek advice from a financial advisor if needed. While Bitcoin presents exciting opportunities, it’s essential to approach it with caution and informed decision-making. As the cryptocurrency market evolves, staying informed and making responsible investment choices will be key to success in Bitcoin.

Related Article:

-

Top2 years ago

Top2 years ago2022 US House committee releases Trump’s tax returns, capping a years-long battle

-

News1 year ago

News1 year agoUSPS EMPLOYEE ASSISTANCE PROGRAM SERVICES AND BENEFITS

-

Top2 years ago

Top2 years agoInterview With Niantic CEO John Niantsullivan

-

Top1 year ago

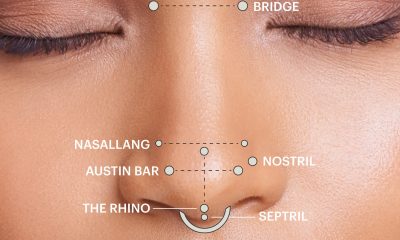

Top1 year agoUnderstanding the Healing Process of Nose Piercings – A Comprehensive Guide

-

Auto1 year ago

Auto1 year agoTop Porsche Taycan Incentives: Save Big

-

Business12 months ago

Business12 months agoDoes 7-Eleven Take Apple Pay

-

Business11 months ago

Business11 months agoBeware Of Fake Emails And Fake Apple Pay Images

-

Tech1 year ago

Tech1 year agoUSPS LiteBlue ePayroll: A Comprehensive Guide